The receiver (drawee) cannot cash the check from the bank as the issuer already mention the effective date. The bank will not withdraw the cash even the account has enough balance. If they need the cash early, they should bring back the check and ask the issuer to renew with an early date.

Communicating Outstanding Checks to Payee

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. As a general disclaimer, the information provided above is very general and broad in nature, is not represented as complete, and may not apply to taxpayers’ individual situations. We advise all taxpayers to consult a professional tax advisor regarding their own specific needs. The eRoutingNumber™ database Includes All ABA Routing Numbers in the United States, as well as the bank website in many cases. The eRoutingNumber™ database also contains the bank phone number and best number to call for check verification. Outstanding checks aren’t necessarily inherently bad; however, there are some risks and downsides to have checks linger.

- Sometimes you might need to sign a cheque over to allow someone else to deposit it.

- A postdated check is simply a check that has been written with a future date.

- So both issuer and receiver should have some procedure to prevent such an issue before it reaches the banks.

- Furthermore, the policy must state the rules about the action to be done if the recipient does not cash the amount that you have issued in business.

- If they need the cash early, they should bring back the check and ask the issuer to renew with an early date.

- Now, let’s dive deep into understanding a stale-dated check and how it functions.

- If you try to cash a stale check or someone tries to deposit a stale-dated check that you’ve written, here are a few things to look out for.

What are stale dated checks?

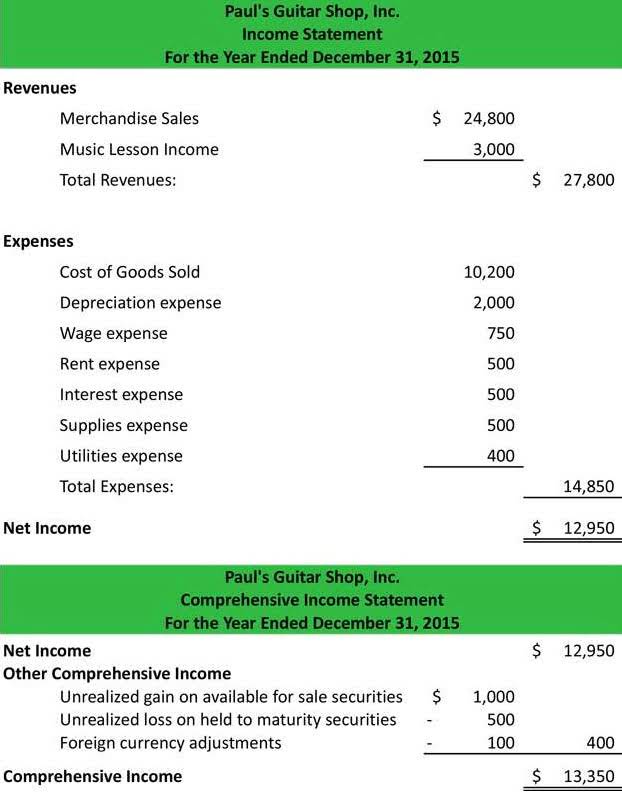

PNC Bank understands that managing finances can be complex, and we’re committed to offering tools and account features that can help you meet your financial obligations. Accumulating a balance that can’t be paid off within the grace period can lead to high interest charges, https://www.bookstime.com/statement-of-retained-earnings-example which can increase financial strain. A credit card can be an excellent option when your cash flow isn’t quite enough to meet your financial obligations. Using a credit card can help you pay your bills on time while also potentially earning cash back or other rewards.

- This can be safely disregarded as an attempt to remind people not to hold a check for too long.

- Each bank has its own check hold policies, check endorsement requirements, and clearance period.

- If you’ve postdated a check and the recipient cashes it early, there are a few different scenarios that may occur.

- As a business owner, you should take time to clearly outline how your company handles stale checks.

- The main purpose of a cheque is to make payments conveniently without the need to carry large amounts of cash.

Are these checks valid?

However, dealing with physical checks poses a challenge – keeping track of their whereabouts. They can easily be misplaced or accidentally discarded with other waste. Losing a check or delaying its deposit can result in it becoming stale-dated. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. If you have a problem with a stale or expired check, it’s best to consult with a financial lawyer who can advise you on the best course of action.

Moreover, cheques are convenient because they can be post-dated, which means you can write a cheque today for payment next week, next month, or even next year. This can be helpful if you need to make a large payment but don’t have the funds immediately available. Finally, cheques offer a degree of safety that other methods of payment do not.

There are forms that need to be completed and you will need to remit the funds to the state. The state will then hold those funds while they attempt to find the payee. The eRoutingNumber™ database uses many different sources and has evolved since 1998, and now utilizes user reporting to keep the data in check.

How Outstanding Checks Work

With this in mind, it’s best to process a check as soon as possible to avoid complications or delays with processing, which also ensures avoiding stale-dated checks. If a bank does elect to cash or deposit a check for you, this does not mean the balance of the check will be immediately available. Each what does stale dated check mean bank has its own check hold policies, check endorsement requirements, and clearance period. – If you’re the one who wrote the check and it has yet to be cashed, check with the recipient to see if they still plan to cash it. Be considerate — call or text the payer to let them know your intent.

What to do if a business owner notices stale dated checks in his books?